Many electric utilities, experiencing stagnant usage and revenue, are looking to increase electrification by promoting electric vehicles. Cooperatives and municipal utilities also want to ensure their customers have access to the same high-tech offerings as power customers in cities and suburbs.

About 20 million EVs will increase energy demand by about 60-95 terawatt-hours of electricity and peak load by 10-20GW, according to a report from The Brattle Group, a leading global energy research firm. That’s why many utilities are investing in ways to not just incorporate but drive EV adoption.

Utilities can promote EVs by working with local governments to ensure adequate charger infrastructure, or they can go to customers directly by promoting EV awareness, electrification, utility program adoption or data presentment of EV charging.

Locating EVs on distribution networks is a challenge

As more people begin buying EVs, however, utilities face a challenge. How do they handle the impact of EVs on the grid?

First and foremost, utilities should locate where the EVs are in their service territories. Without this knowledge, utilities are operating blind. Many utilities know the number of EVs in their territories; they just do not know where they are.

One EV manager at a large southeastern utility, for example, told me 1800 EVs resided in the utility’s territory according to available consumer data, but only one-third (600) of those owners sought the utility’s EV rebate. If the utility had known the location of the EVs, the utility could have identified significantly more users eligible for the rebate program.

Maybe, more importantly, the utility could not incorporate those EVs into its load planning, which could lead to more outages and ultimately hurt the utility’s reliability.

Machine learning to the rescue

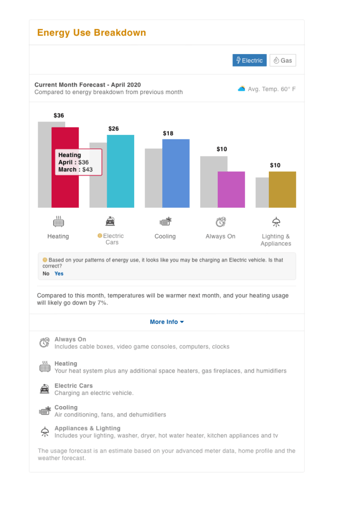

Thanks to machine learning solutions (from vendors such as Aclara), utilities now can identify where EVs reside. New EV detection and machine learning algorithms can disaggregate each customer’s usage by detecting the presence of EVs, air conditioning, heating, lighting and always-on appliances.

The algorithms can then identify how much each category uses and present that analysis to customers via text, email or a Web. You can even forecast next month’s usage based on previous usage (as shown in screenshot below). The analytics use 15-minute data to measure the usage of EVs in part by separating the long-term, multi-hour charging of EVs vs. the cycling of refrigerators or other appliances that typically operate for 15 minutes or less at a time. Aclara’s approach, for example, to AMI disaggregation is to:

- Detect EV signatures

- Identify weather-sensitive load from heating or cooling

- Detect non-weather sensitive appliances

- Allocate baseline “always-on”

This approach combines the disaggregation with customer segmentation data to personalize messaging to customers/members with EVs and empower them with better insights about charging their electric vehicles. With EV detection, utilities can then target EV owners with messages promoting EV programs, TOU rates, or eco-friendly offerings.

Support operations teams

Utility operations can benefit from this capability too. EV detection can enhance utility operations by helping to avoid transformer overloads. For example, if multiple people on the same transformer charge their EVs simultaneously, it could blow out the transformer. That would require a work crew to travel to fix the outage, potentially after hours when it costs the utility overtime pay.

But by knowing the location, utilities can proactively replace the transformer with a higher rated one during normal business-hour or urge those customers with EVs to charge their vehicles during off-peak hours through incentives or an EV rate of some sort.

Are dedicated meters required to measure EV charging?

To enable customer-friendly EV rates, many Aclara customers and prospects have considered installing a specialized meter at each EV owner’s residence to measure electricity for charging. Some utilities want to implement an EV or off-peak rate or provide a rebate on that charging that requires a special meter to measure the EV charging so the utility can bill that usage at the specialized EV or off-peak rate.

Some utilities have expressed that they have explored partnering with one or multiple EV companies to promote and use their respective chargers. But that puts utilities in the position to pick winners and losers in the EV marketplace, which is understandably disconcerting to utility decision-makers.

Many utilities have installed or are considering installing a special meter at each EV owner’s residence to measure electricity used for charging to facilitate either an EV or off-peak rate or an EV charging rebate. The additional meter enables the utility to bill EV charging at the specialized EV or off-peak rate.

However, utilities that will not initially measure EV charging can delay the need to add a meter by using EV detection software temporarily to help enhance reliability and load planning in the short-term.

Take Cobb EMC’s NiteFlex program for example. The utility, just north of Atlanta in Marietta, offers a special, overnight rate where ALL electricity usage up to 400kWh is free. This motivates customers to charge their vehicles at night without the need for a second meter.

Another approach to detecting EVs

Utilities should seek EV detection and related data management and collection capabilities that benefit customers and utility operations with features related to:

- Identifying the location of EVs

- Encouraging EV owners to charge off-peak

- Supporting the implementation of public EV charging infrastructure,

- Promoting EV ownership and

- Enabling the utility to identify the impact on the grid.

But first, utilities should start their EV journeys by identifying where the EVs are in their territories. They should seek solutions such as Aclara’s EV detection designed to engage the members/customers by increasing awareness, utility program adoption, and data presentment related to EVs. Solutions should provide the user with a directed user experience, leading members to content relevant to them, and enticing them to take action through insightful messaging via text, phone, or Web specific to each user.

Importantly, as customers increasingly adopt distributed energy resources (DER), facilitating EV adoption can help utilities establish themselves as the trusted adviser/power provider. For cooperatives and municipalities, this can mean bringing technology to underserved areas. Utilities should adopt solutions that empower their members with better insights for their electric vehicles, enabling them to make more informed decisions, and ultimately enhance their satisfaction with their utility.